Code Section 552.101 et seq. c. (Sections 552.10(d) and 552.13(a) of the Code of Sec- tons 552 and 552.104 of the Civil Practice Act provide that there must be no more than two years elapsed from the time of sale for which payment is sought and the sales tax paid at such time; e. The sales tax must be paid in the currency in which it is collected (e.g., checks or money orders); g. If the sales tax is paid to an IRS-approved electronic fund transfer agent, the sales tax must be paid electronically through the Internet; h. Payments may be made by personal check or money order and must: i. Be made within 60 days from the date they are due; ii. In the case of a personal check, be drawn on a bank that makes the payment of personal checks to the individual; iii. In the case of a money order, be drawn on a bank that makes the payment of money orders to the individual; and iv. Include only an amount that is equal to the sales tax for each fuel type (based on the date of payment, if available); j. The total sales tax due must be in the amount and form required and must be mailed to the address under Section 56100.6; k. No refund if payment is made by a credit or debit card that is issued to the taxpayer. The seller must certify the accuracy of the payment prior to processing it; 51.13 (R.6-7.07(3 m)) 51.13(3 m)(a) (Reviser's note: This rule was removed from the Tax Law Review in 1995 as part of the Uniform Transmittal of Federal Tax Law Amendments to the Code of Federal Regulations, published at IRS.gov ()). 52.00 (R.6-7.07(2a)) 52.00(2a)(b) (Reviser's note: This rule was deleted in 2016 and replaced with the following under Section 6702.5(g) on June 1, 2019: (g) For purposes of determining the number of days required to make the sales tax payment, see Section 6702.5(k) of this title (19 U.S.C. 6702(g)). 52.00(5) (R.6-7.07(3 m)(a)) 52.

Get the free form 56 102

Show details

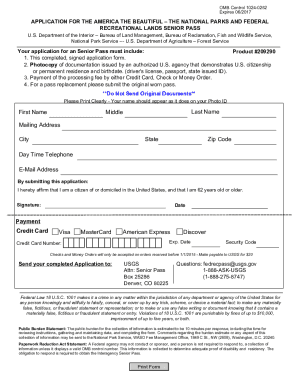

Use a separate Form 56-102 for each fuel type. 56-102 (Rev.6-14/8) IFTA Fuel Tax Report Supplement PRINT FORM CLEAR FIELDS Instructions in English b. b 56100 56100 Original a. T Code b c. Texas taxpayer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 56 102 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 56 102 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 56 102 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 56 102 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Fill form : Try Risk Free

People Also Ask about form 56 102

How long does it take to get IFTA in Texas?

Can I drive without IFTA sticker in Texas?

How much does it cost to get an IFTA in Texas?

How do I get a Florida IFTA sticker?

What is the IFTA reporting form for Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file form 56 102?

Form 56, Notice Concerning Fiduciary Relationship, is typically filed by an executor, administrator, trustee, guardian, or other person acting in a fiduciary capacity on behalf of an estate, trust, or individual. It is used to notify the IRS about the appointment of a fiduciary and to provide relevant information about the taxpayer(s) involved.

How to fill out form 56 102?

Form 56 102 is not a specific form listed by any recognized government or organization. There may be a mistake or a specific regional or organizational requirement associated with this form number.

To ensure accurate guidance, please provide more information about the form such as the issuing organization or the purpose of the form.

What is the purpose of form 56 102?

Form 56 102 is used by the Internal Revenue Service (IRS) to authorize an individual or entity to act as a fiduciary on behalf of another party. The purpose of this form is to allow the appointed fiduciary to handle the tax matters and communications with the IRS for the related taxpayer or estate. It provides important information about the fiduciary's authority and responsibilities, including the ability to receive and inspect confidential tax information and represent the taxpayer or estate before the IRS.

What information must be reported on form 56 102?

Form 56 102 is not a recognized form in the United States tax system. Therefore, there is no specific information that must be reported on this form. It is possible that you may be referring to a different form or a form used in a different country. If you provide more information or context, I would be happy to assist you further.

How can I edit form 56 102 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 56 102 form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for the ifta 56 102 form in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ifta form 56 102 in seconds.

How can I fill out form 56 102 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 56 102 form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your form 56 102 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifta 56 102 Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.